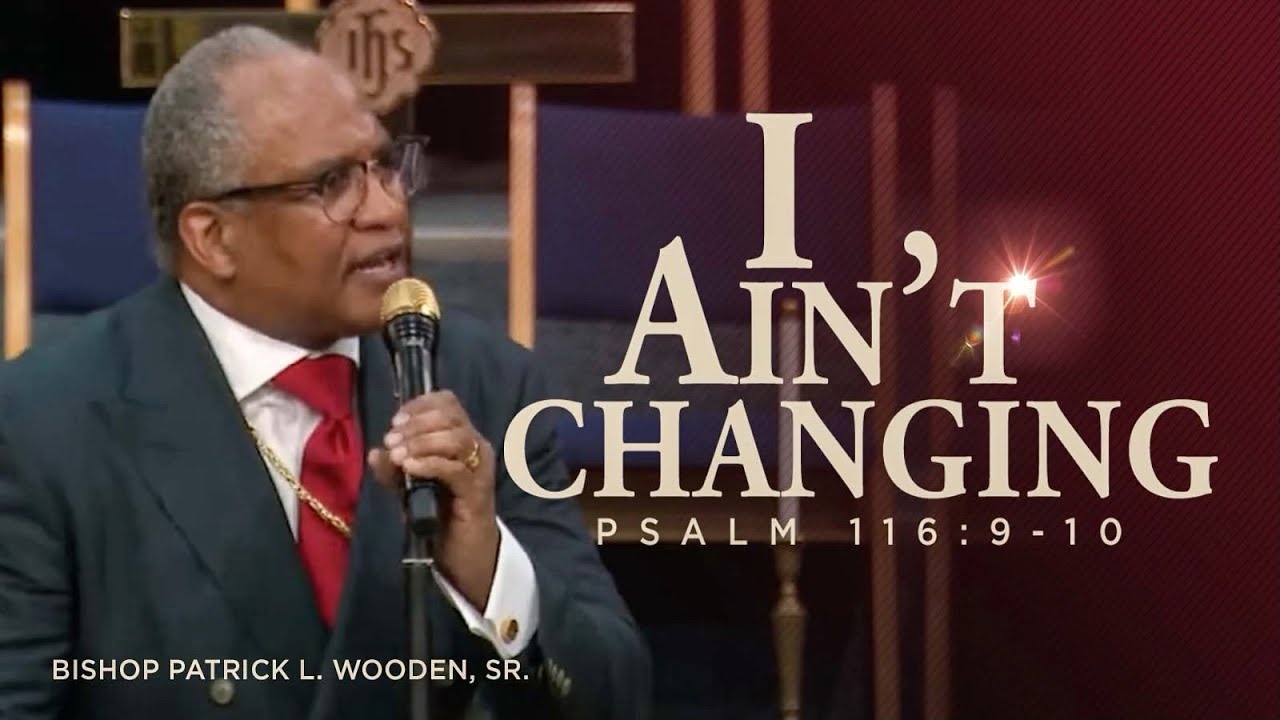

In a recent sermon, Bishop Patrick L. Wooden expressed his decision to “disassociate” from a particular political party, a stance he delivered passionately without explicitly naming the party, in adherence to the restrictions placed on his church’s nonprofit status under the IRS 501(c)(3) code. This careful balance allows religious leaders to discuss matters they deem important while avoiding direct political endorsements or affiliations that could jeopardize their tax-exempt status.

Bishop Wooden’s approach reflects the complex position that many church leaders find themselves in today. Under the rules of 501(c)(3), religious organizations are prohibited from endorsing political candidates or engaging in partisan activities. This regulation is in place to ensure that tax-exempt institutions do not use their platform to influence elections. However, it can be difficult for pastors and religious figures to refrain from expressing strong political opinions when their moral or spiritual beliefs intersect with political issues. The IRS stipulates that while churches can engage in issue advocacy, they must stop short of partisan campaigning or risk losing their tax-exempt status (IRS.gov, 2023).

For many Christians, particularly those who strongly align their faith with political stances, it can be challenging to comprehend why a religious leader would avoid outright endorsement of political positions. Bishop Wooden, like many others, navigates this tension between religious conviction and legal constraints. By complying with these rules they ensure that their church retains its tax-exempt status, which allows it to continue receiving tax-deductible donations and avoid federal income taxes, benefits that are vital for the financial sustainability of many churches.

There is merit in the resolve of pastors like Bishop Wooden who seek to voice their convictions while respecting the legal parameters established by 501(c)(3). However, they do indeed walk a fine line. Leaders like him face the challenge of maintaining their moral authority while adhering to the restrictions imposed by their nonprofit status, a task that can feel at odds with their pastoral duty to speak truthfully and boldly.

Critics of the 501(c)(3) framework argue that it creates a form of institutional entanglement, where the church, as a body, becomes beholden to the state in ways that potentially limit religious freedom. Some even suggest that churches should reconsider their nonprofit status altogether to avoid these entanglements. On the other hand, those who have taken on this responsibility are obligated to carefully follow the rules they agreed to, navigating the risks and responsibilities that come with it. When Pastors see the truth that’s outlined in the below PDF who is required to file for this status, many ignore it as far fetched. However, the black letter law spells out exactly who this requirement applies to.

While some pastors may have entered into the 501(c)(3) structure without fully understanding the limitations it would place on their ability to speak on political matters, those that remain in it must proceed cautiously. By doing so, they ensure they do not cross into the “unacceptable territory” of political endorsement, preserving both their church’s integrity and their tax-exempt status.

In conclusion, religious leaders like Bishop Patrick L. Wooden must navigate a complex and often challenging landscape. The legal framework governing 501(c)(3) entities requires a delicate balance between their moral convictions and their commitment to follow the legal obligations they’ve accepted. Their efforts to maintain this balance are commendable, but it is a fine line that requires ongoing awareness and careful navigation to avoid significant legal or financial consequences.

References:

- IRS.gov. (2023). Tax-Exempt Status for Churches and Religious Organizations